Confidently start your Canada Pension Plan retirement pension

The CPP Calculator helps you choose the best date to start receiving your CPP retirement pension by providing you with accurate calculations and detailed projections.

This calculator is the only online calculator created and endorsed by CPP expert Doug Runchey to be 99.9% accurate when compared to your actual CPP benefit.

Our Calculation Guarantee

Papyrus Planning guarantees that its Canada Pension Plan calculations are 99.9% accurate, based on the information provided by the client, in accordance with the current legislation and using current-year dollars.

If Papyrus Planning's calculations are found to be wrong by more than 0.1% for reasons other than inaccurate or incomplete information from the client, legislative changes or inflation then Papyrus Planning's liability is limited to a full refund of the fees paid for those calculations.

What does the CPP Calculator do?

The CPP Calculator clarifies when to start your CPP retirement by:

- Allowing you to input your current year-by-year pensionable earnings record from Service Canada, because you cannot perform an accurate calculation using just the Service Canada estimates or by entering just your number of maximum years of earnings and contributions.

- Allowing you to input your current and future employment earnings using different scenarios.

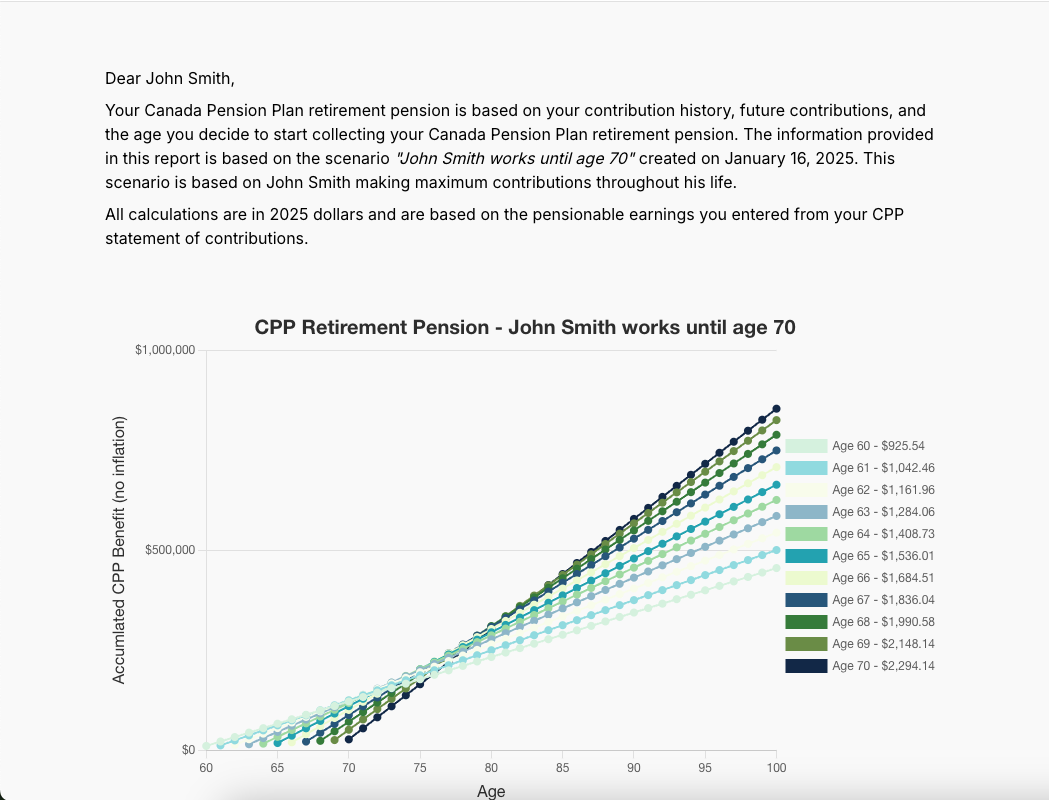

- Calculating your monthly CPP retirement pension for each year from age 60 to age 70.

- Using the child-rearing dropout provisions (CRP) to accurately calculate the impact on your CPP retirement pension amount—a feature unique to the CPP Calculator.

- Allowing couples who co-parented children under age seven to determine the impact on their benefits so they can find the best way to share the child-rearing dropout provisions.

- Telling you how much registered savings you'll need if you want to delay your retirement pension.

This Canada Pension Plan Calculator will use your Statement of Contributions to provide you with how much income you can expect depending on which age you start your CPP benefits.

Why should I calculate my CPP retirement pension?

The Canada Pension Plan is a significant source of retirement income. Deciding when to start your benefits can have a tremendous impact on your lifetime retirement income because:

- The retirement pension can be up to 36% less by starting at age 60 or up to 42% greater by starting at age 70—a possible difference in income of around $1,100 a month.

- A small percentage of Canadians receive the full retirement pension amount, so knowing exactly how much to expect is important to deciding when to start.

- The CPP retirement pension amount is taxable income, so the timing and amount of your benefit could affect benefits such as the Guaranteed Income Supplement and Old Age Security—as well as other tax credits.

- The retirement pension is payable for your entire lifetime—no matter how long you live.

- The retirement pension is adjusted for inflation throughout your entire lifetime—no matter how long you live.

- A portion of the pension will continue to your spouse if you die.

- If you have children, your amount is likely greater than estimates provided by Service Canada.

Service Canada provides an estimate of your CPP retirement benefit, usually at age 60 (or next month if you are over age 60) and at ages 65 and 70. If you are close to one of these three ages, the estimate may be fairly accurate. Because all three estimates are based on your current average lifetime earnings, they may be either too high or too low. These estimates also do not usually include credit for the child-rearing provision. For all of these reasons, many people want a better estimate than Service Canada provides, and that is why the CPP Calculator exists.

Who should use the CPP Calculator?

The CPP calculator should be used by anyone who wants accurate calculations of their current and future CPP retirement pension options, under various scenarios. Using these calculations, you should be able to make better decisions regarding when to take your retirement pension, how to share the child-rearing provision.

The CPP Calculator will be particularly useful if you:

- Want to see how changing your retirement date will affect the amount of your CPP retirement pension.

- Expect that your future employment earnings will be higher or lower than your current average lifetime earnings.

- Were the primary caregiver of children under age seven, and you might therefore benefit from the child-rearing provision under the CPP.

- Co-parented when your children were under age seven and want to try various scenarios of sharing the child-rearing provision in order to select the best overall strategy for claiming this provision, based on how it impacts both of your CPP retirement pension calculations.

- Immigrated to Canada late in life and/or began working in Canada long after age 18.

- Are self-employed by your own corporation and want to decide whether to pay yourself salary and contribute to the CPP, or pay yourself dividends and not contribute.

- Want to know how much registered savings you will need if you delay your retirement pension.

Who is the CPP Calculator not for?

The CPP Calculator is not the right tool for you if:

- You are receiving a survivor's benefit. We hope the CPP Calculator will be able to provide estimates for people receiving survivor's benefits in the future. For now, you may request a manual calculation.

- You are currently receiving a CPP disability pension. We hope the CPP Calculator will soon provide a simple tool that will calculate how much a CPP disability pension will convert to in the form of a CPP retirement pension at age 65. For now, you may request a manual calculation.